How to Open Bank of Baroda Account Online? Using Video KYC Process

Bank of Baroda is the second-largest bank in India providing all kinds of financial services to the customers including Bank account opening online.

In this column, we will discuss how to open a Bank of Baroda account online, the documents required, the process of account opening, video KYC norms, etc.

Bank of Baroda is one of the best public sector banks providing facilities like a private premium service bank. You can also apply to open a bank account digitally using the eKYC option.

You can use the digital option to open a bank account where your KYC will be done digitally using your Aadhaar card and video KYC.

Before applying make sure you have documents ready and the device that you are using to access the website of the mobile app has a working webcam.

Documents and Device Requirement for Bank Account Opening

The following are the documents that the applicant must have to open a bank account-

- PAN Card

- Aadhar Card

- Operational Mobile number Registered with Aadhar No

- Valid Email ID

- Internet, Camera/Webcam & Microphone enabled Mobile/Device

- Enable browser Location of the device used for Account opening

Process for Applying for BOB Bank Account Online

You can open a bank account online using both a desktop browser or using a mobile app. To open a bank account online using a Bank of Baroda website, you can follow these step-by-step instructions-

- Visit the official website of Bank of Baroda or download and install the BOB world app

- Navigate to the Account dropdown tab followed by clicking on the ‘Open A Savings Account Digitally’

- After clicking on the button, you’ll be provided with multiple savings bank account options to choose from. You have to choose the best savings account that suits your preferences.

- Now, you’ll be prompted with a disclaimer, click on the yes button to continue

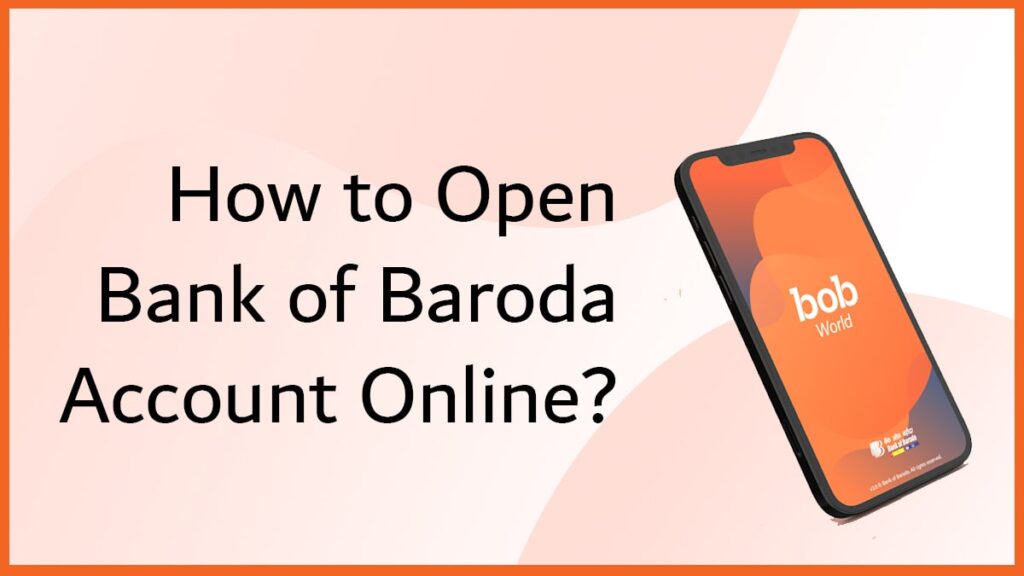

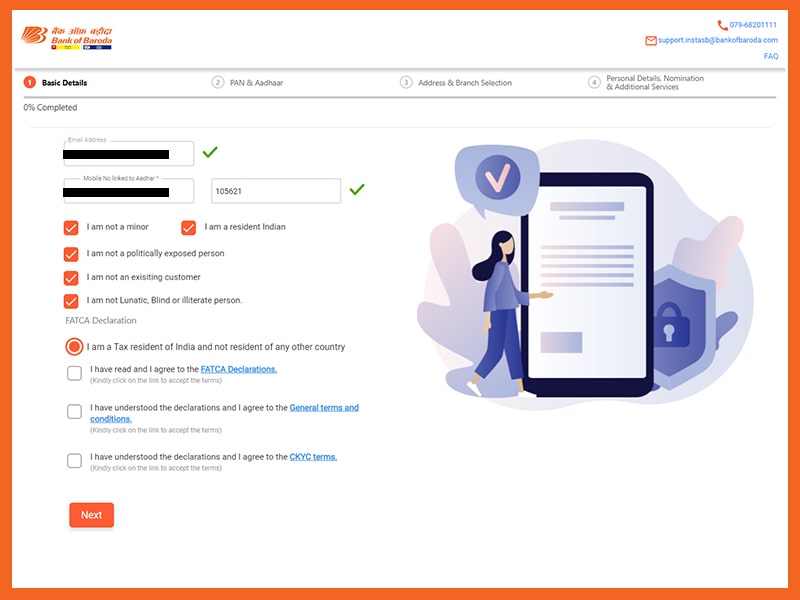

- A form will appear where you have to mention your email ID, mobile number, and different checkboxes asking for basic questions(fill the boxes accordingly)

- Now, you’ll receive OTP on your mobile number which you have to fill and on your email ID activation link. Click on the link sent on your email to verify your email

- Now click on the Next button, now, you’ll have to fill in the Aadhaar card number, PAN Card number

- An OTP will be sent to your registered mobile number(with UIDAI) which you have to enter into the given box followed by clicking on the Next button

- Now, your profile details will be automatically filled in, you just have to select your nearest bank branch using the drop-down option and click on the proceed button to continue

- After clicking on the proceed button, you’ll be redirected to a new page where you have to fill in your personal details like father name, mother name, religion, education, employment, etc. and click on the proceed button

- After clicking on the proceed button, you’ll have to choose the additional services that you want to have like net banking, cheque book, UPI, etc.

- Now, click on the proceed button, and a final form which is filled by you will appear that you have to check followed by clicking on the submit button

- After successful submission of the form, you’ll receive a URN number, keep it safe for future use, you’ll also get an SMS containing the URN number

- Now, you’ll receive an SMS containing a link for the doing video KYC using your mobile device

- Click on the link followed by clicking on the get OTP button, you’ll receive an OTP on your mobile number that you have to fill in

- Here you have to select the slot of video KYC data and time

- Now, on the selected time and date, you have to open the link once again and log in using the OTP

- You have to press on the allow for the camera, microphone, and location on the device you are using for video KYC

- Now, complete your KYC option will appear, here, you have to click on the Start button

- A bank representative will be joining you live for a video KYC, he/she will be processing your video KYC via the internet

- You’ll be asked different questions which you have to answer along with typing the questions

- After successful KYC process, you’ll be notified once your application is processed

- You’ll receive a starter kit containing your new Bank of Baroda checkbook, passbook, debit card, etc.

After you have received the welcome or starter kit via post, you’ll have to activate the following to use your bank account-

- Activate BOB Debit Card

- Activate BOB Mobile Banking

- Activate BOB Net Banking

- Activate BOB UPI

I’m Shiv Kumar, a graduate with a passion for finance, marketing, and technology. My journey into finance started with a desire to understand money management and investing.

Our main goal is to empower individuals through financial education. We believe that everyone should have the opportunity to build a strong financial foundation. Whether you’re a seasoned investor or just getting started, we provide articles, guides, and resources to help you navigate the financial landscape.

I invite you to join our community of financially savvy individuals. Feel free to ask questions, engage with our content, and explore the topics that matter to you. Together, let’s take control of our financial futures.