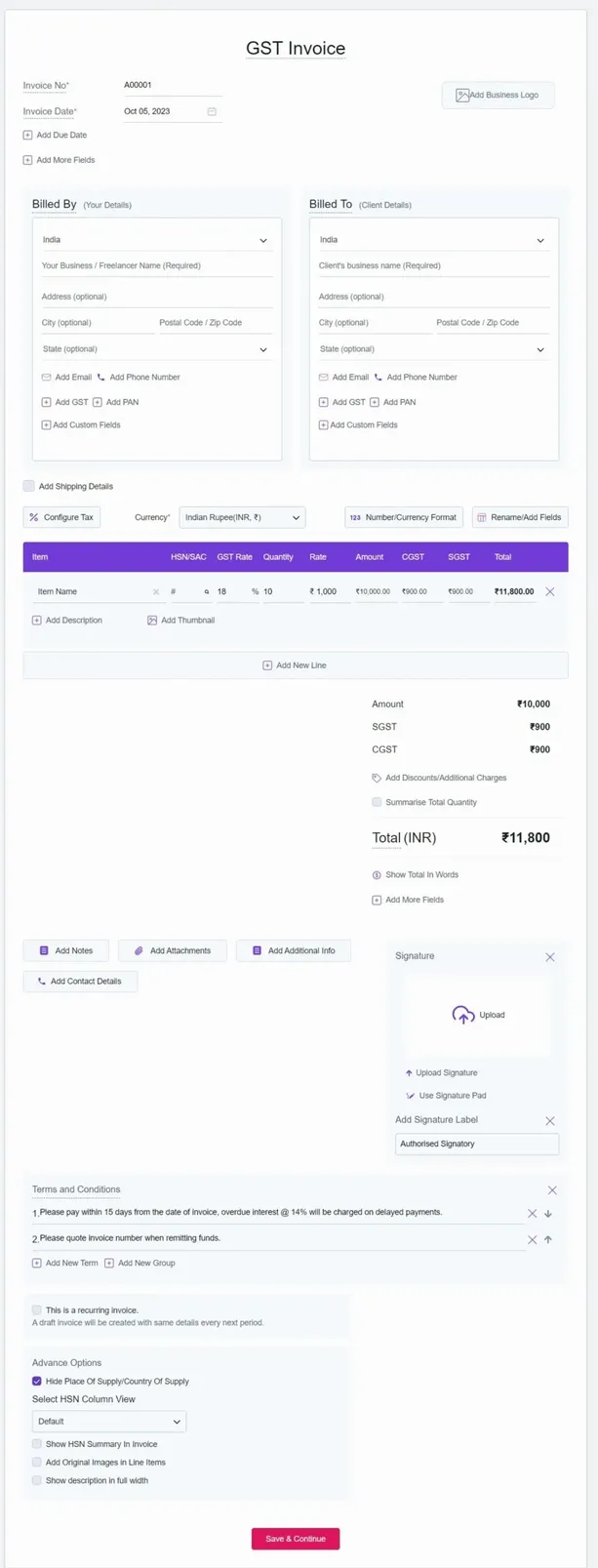

Create GST Invoice Generate professional GST invoices effortlessly with our GST invoice maker. Customize your invoices to match your brand and ensure compliance with Indian tax laws.

IRN Invoices & E-Way Bills Our bill maker supports IRN invoices and e-Way bills, ensuring that you stay compliant with the latest regulatory requirements. Streamline your invoicing process and focus on growing your business while we handle the compliance details.

Client Management Effectively manage your clients’ data within our platform. Keep track of pending invoices for specific clients, ensuring that you are always up-to-date with your financial transactions.

Invoice Monitoring Stay informed about your invoices’ status. Email invoices directly to clients and receive notifications indicating whether the invoice has been opened. This feature empowers you to engage effectively with your clients and maintain transparent communication.

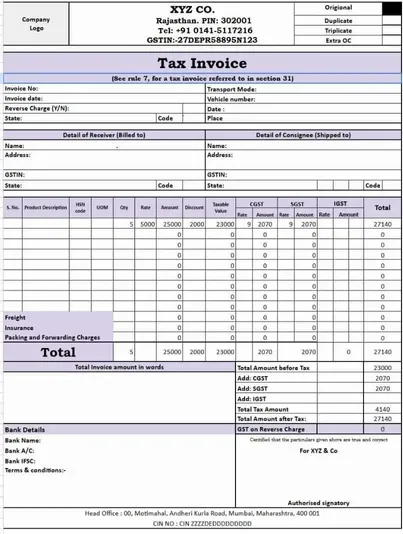

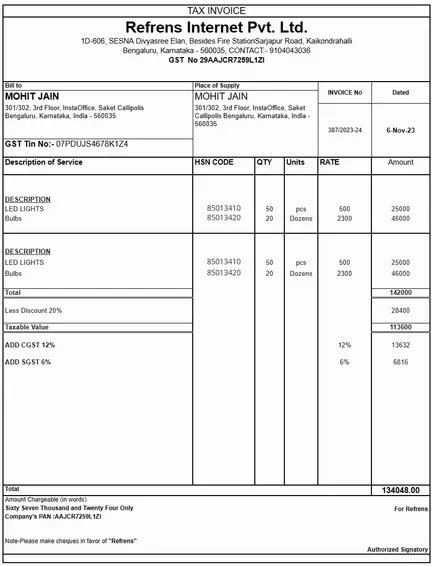

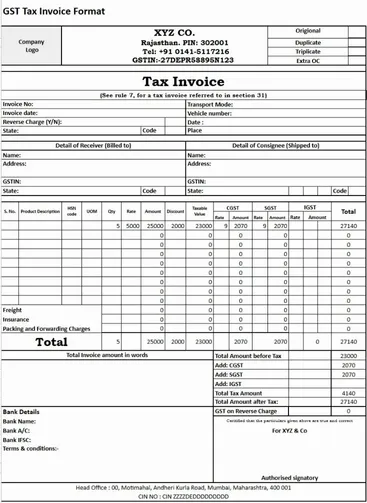

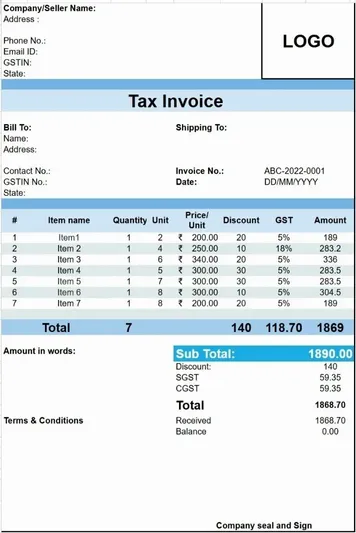

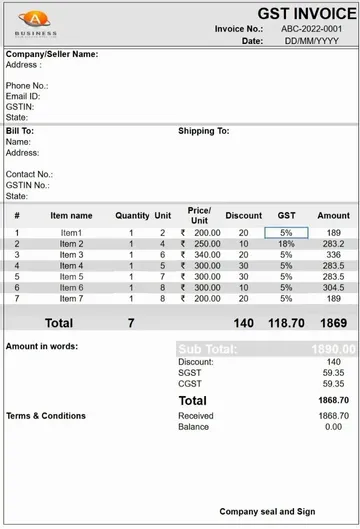

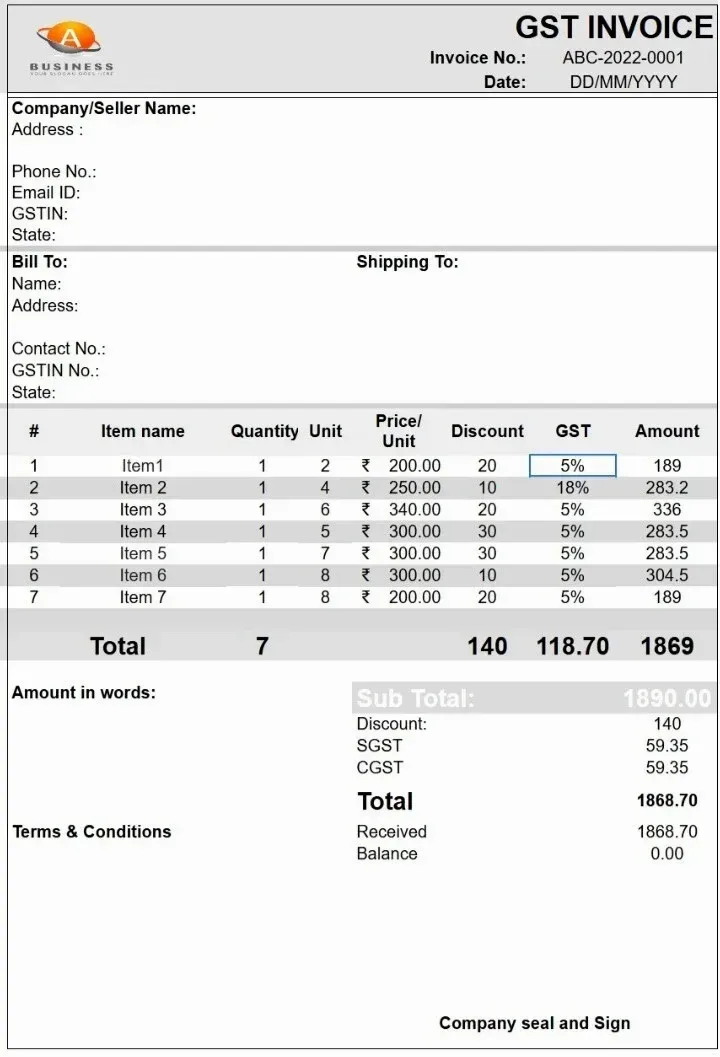

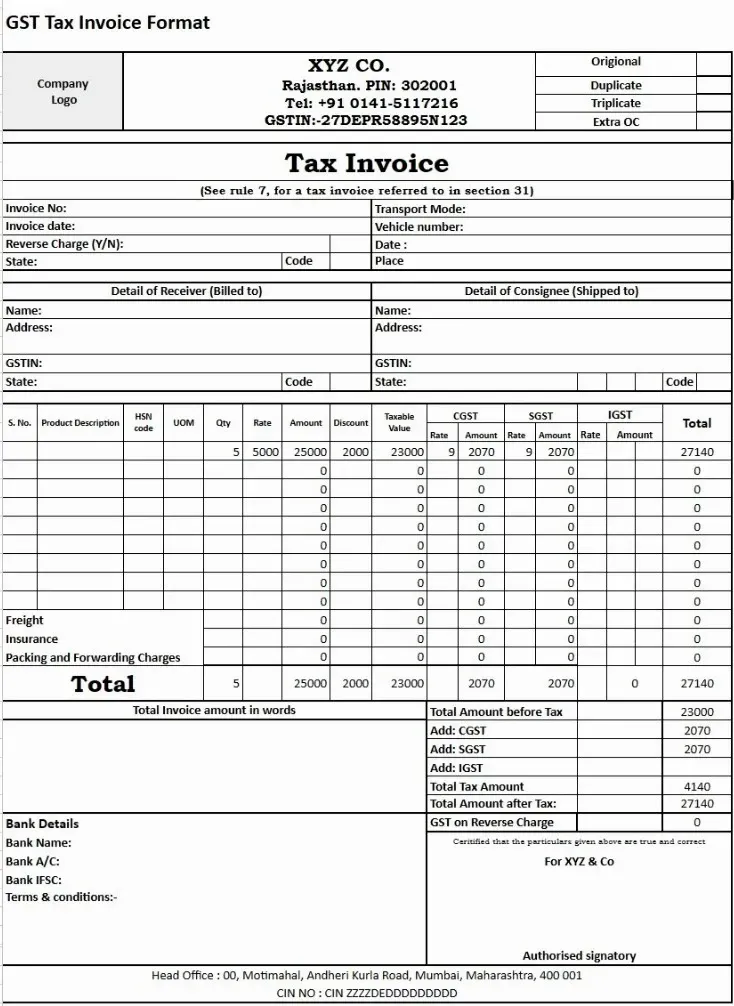

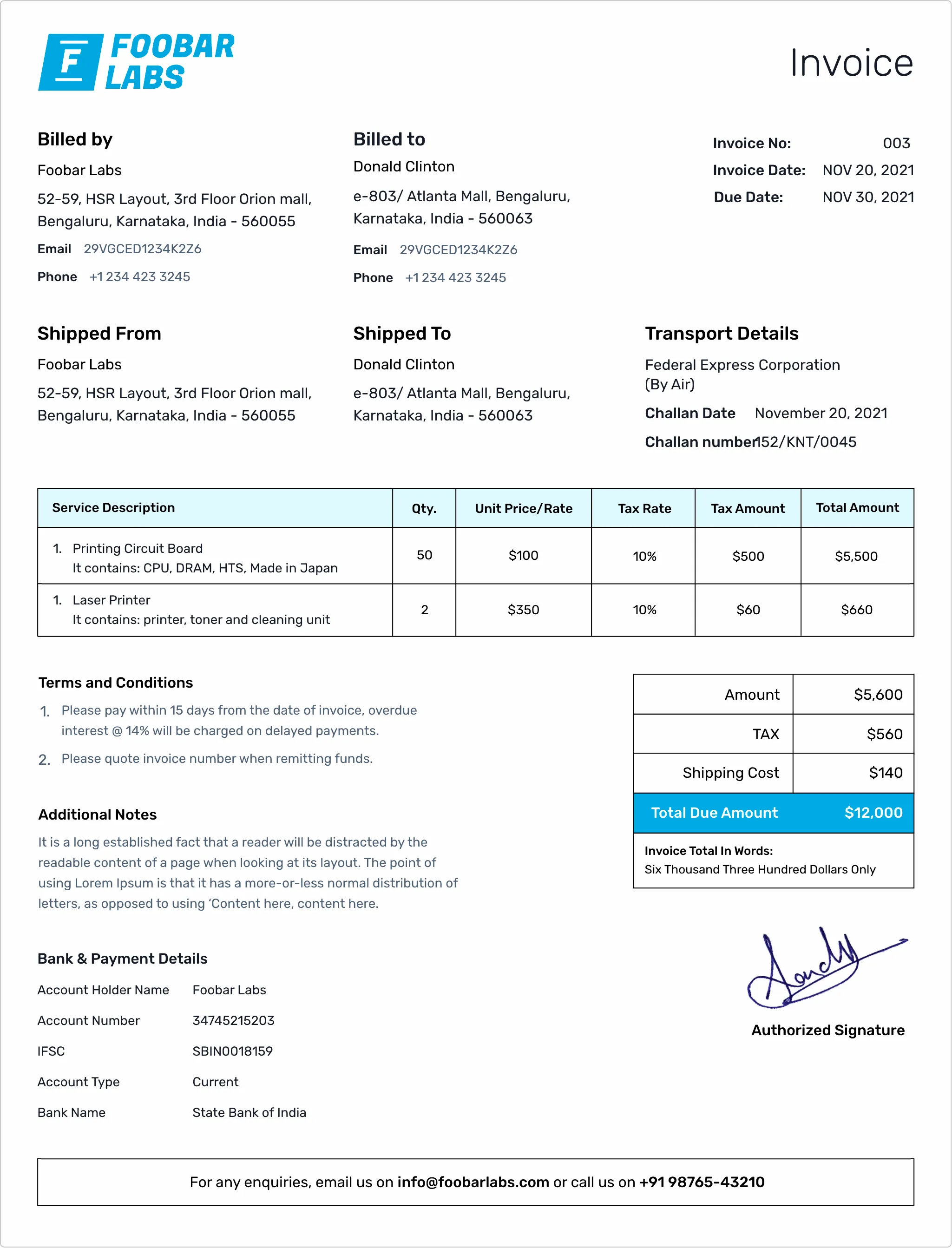

GST Bill Format Choose from a variety of GST bill templates to create invoices that are both stylish and compliant. Our templates make it easy to generate GST bills that fit your business needs.

Share GST Invoices Easily share your GST invoices with clients via email or link. Our GST invoice generator simplifies the sharing process, ensuring your clients receive their invoices promptly

Record Payment Keep track of payments effortlessly with our GST invoice format. Record and manage payments directly within the invoice for seamless financial tracking.

Recurring GST Invoices Automate your billing process with recurring GST invoices. Our GST invoice generator allows you to set up regular invoices, saving you time and effort.

Custom Tax Formula Tailor your invoices with custom tax formulas. Our GST bill generator supports unique tax requirements, ensuring accurate billing for every transaction.

Track GST Invoices Stay organized by tracking all your GST invoices in one place. Our GST invoice maker helps you monitor paid and unpaid invoices, streamlining your accounting.

Edit HSN Column view With Refrens' GST invoice maker, you can quickly update and manage HSN codes for precise tax calculations and clear invoicing. This ensures tax compliance, smooth customs processes, and better transparency in transactions.

GST Summary in Invoice Get a clear GST summary on each invoice. Our GST invoice template includes a detailed breakdown, making tax compliance straightforward.

GSTR-1 Reports Generate comprehensive GST reports with our GST bill format. Easily compile GSTR-1 reports, simplifying your tax filing process.

Add Cess Include cess in your GST invoices effortlessly. Our GST bill generator allows you to add cess details other than GST if any particular state charges extra cess, ensuring complete tax compliance.

Save Client Details Store client information securely within the GST invoice maker. Quickly access client details for faster invoice creation and management.

Add Shipping Details Include detailed shipping information in your GST invoices. Our GST bill template supports comprehensive shipping details, keeping everything in one place.

Add Transport Details Easily add transport details to your GST invoices. Our GST invoice format ensures all necessary information is included, enhancing clarity and compliance.

Add Attachments Attach relevant documents to your GST invoices. Our GST invoice template allows for easy attachment of supporting files, keeping your records thorough and organized.

Safe, Secure, Reliable Trust our GST invoice maker for secure and reliable invoicing. Your data is protected with top-notch security measures, ensuring peace of mind with every transaction.

24/7 Assistance Get help anytime with our 24/7 support via email and live chat. We'll quickly resolve any issues or answer your questions, so you can stay focused on your business.

Free Plan All of our premium features are available on a free trial. Experience what all Refrens has to offer without making any payment!

Premium Plan Manage your accounting at faster pace with additional premium features at minimal cost.Tally was too complicated for me. Zoho? Too expensive. Refrens GST Billing Software hits the sweet spot - it's simple, it's feature-rich, and it's value for money.

Aniket Owner, Spaceplexx, Coworking SpaceFinding a good GST billing software for my small business was tough. Then I found Refrens, and it changed everything.

Snehal Bhatt Owner, Nexait LLC, AgencyCollecting USD payments was always a headache. With Refrens' online invoicing software, it’s a breeze.

Nayan Founder, Sugoi Labs, Software Services AgencyAs a freelancer, Refrens' billing software with GST has been a blessing. It's smooth and easy to use.

Linkee Freelancer, Content WriterWe provide GSTR-1 report which is helpful for filing the taxes. If you need any report that is not currently there, you can request us on chat support, we will get it included in our system.

Can I save my bills to this GST bill format?Yes. All the bills created by you are saved online. You can access all the bills and invoices anytime just by logging to your account.

Can I save my client details to this GST bill format?Yes, you can save and manage all the details of your client under the client management tab. This feature helps you to avoid retying of customer details every time on the invoice.

What are the other free products provided by Refrens? Can I add more details to my bills?Yes, you can add extra details like shipping details, discount, custom fields for both client and line item. Apart from that, you can also upload your logo, signature and attachments.

Does Refrens support different GST bill formats?Yes. Refrens support multiple invoice formats which also include letterhead. You can also change the colour and font headings of the invoice.

What is the place of supply under GST bill?The place of supply includes the location of the buyer or recipient who is receiving the product or service.

Is my data safe?Absolutely. Only you can decide who you want to share the invoices, quotations with. The documents you create are accessible only through special URLs that you share or PDFs that you download. We do not share your data with anyone for any purpose.

Can I receive payments using this invoice generator?You can receive payments via regular banking system like IMPS, NEFT, RTGS and UPI, directly into your account from the client. Such methods of payments have no involvement from our end and we do not charge anything. Refrens has a dedicated payment gateway to receive payments online via Debit card, Credit card, Net Banking, Wallets and International cards. You can also receive international payments in India through our payment gateway. Please see the pricing page for more details on pricing for payment gateway charges for card-based payments.

How does bank account verification work?We initiate the process of verifying your bank account after we have received a payment for any of your invoices. Once your account is verified, we initiate the payouts automatically, subject to clearance from bank. If you are not receiving payments through us, we do not verify the bank account.

Do I have to create Refrens account to use this GST bill format?Yes, Refrens account is necessary to use this GST bill format. While creating an account, you can access all the GST invoices bills in one place and also makes the invoice creation procedure easy.

Mandatory for GST-Registered Vendors:

Components of a GST Invoice:

GST Bill vs. Bill of Supply:

Importance for Input Tax Credit (ITC):

Legal Compliance:

Smooth Audits and Assessments:

An online GST bill refers to the digital representation of a Goods and Services Tax (GST) invoice generated and managed using online invoicing platforms such as Refrens. In the contemporary business landscape, there is a growing shift towards digitization, and online tools are becoming increasingly popular for managing various business processes, including billing.

Using online invoice software like Refrens simplifies the process of creating, managing, and sending GST bills. This approach eliminates the need for dealing with physical files and documents, providing a centralized platform to generate and store all billing information. The convenience of online billing becomes evident in its accessibility, allowing users to retrieve billing details swiftly and efficiently.

Refrens offers a comprehensive solution for handling GST bills online. Whether users need to send, print, or download their GST bills, Refrens provides a user-friendly and efficient platform. This transition from traditional, manual billing methods to the streamlined and automated approach of online invoicing enhances convenience, reduces hassles, and boosts overall efficiency for businesses.

In the business realm, the issuance of a Goods and Services Tax (GST) invoice is authorized for any registered business. This includes businesses that are providing goods or services and are registered under the GST framework. The process involves issuing GST-compliant invoices for the services rendered or products supplied, and, conversely, receiving GST-compliant purchase bills from registered vendors.

Proper documentation of these transactions is paramount for businesses to remain compliant with tax regulations, ensuring accuracy and transparency. By adhering to GST regulations and maintaining thorough documentation, businesses not only avoid potential errors but also foster trustful relationships with clients and vendors. This commitment to compliance is a fundamental aspect of running a successful and reputable business in today's competitive and regulated business environment.

When it comes to creating GST invoices, attention to detail is critical. Failing to include all of the necessary elements in your invoice format can lead to costly mistakes down the road. To avoid these issues and ensure compliance with GST regulations, make sure your invoice format includes the following essential elements:

Invoice Title - Clearly state that the document is an invoice. Example: "Tax Invoice" or "GST Invoice".

Invoice Number - Assign a unique identification number to the invoice for tracking and reference purposes.

Issue Date and Due Date - Include the date when the invoice was issued and specify the due date by which payment should be made.

Supplier Details - Include complete details of the supplier, including name, address, GSTIN (Goods and Services Tax Identification Number), and contact information.

Recipient Details - Provide accurate and comprehensive information about the recipient, including name, address, GSTIN (if registered), and contact details.

Place of Supply - Clearly indicate the place where the goods or services are supplied. This is crucial for determining the applicable GST rate.

Goods/Services Details - Provide a detailed list of goods or services supplied, including names, descriptions, quantities, unit prices, total prices, and relevant HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes.

GST Details -

Shipping Details (If Applicable) - Include the shipping address and other relevant details if the goods are being shipped.

Total Amount Due - Sum up the total amount payable after considering the item rates, quantities, and applicable taxes.

Discounts or Adjustments (If Applicable) - Clearly state any discounts or adjustments applied to the invoice total.

Terms and Conditions - Include any relevant terms and conditions governing the transaction, such as payment terms, delivery terms, or return policies.

Supplier's Signature - The invoice should be signed by the supplier, adding authenticity and credibility to the document.

By including all of these elements in your GST invoice format, you can minimize the risk of errors, ensure compliance with regulations, and maintain a professional and trustworthy image with your clients and partners.

In today's global marketplace, the ability to classify and identify goods and services accurately is critical for businesses of all sizes. To help streamline this process, the World Customs Organization (WCO) developed a regulated system called the Harmonized System of Nomenclature (HSN), which assigns unique 8-digit codes to products and services traded domestically and internationally.

In India, more than 5000 products are classified under HSN codes, making it an essential tool for businesses looking to operate efficiently and stay compliant with GST regulations.

Under GST regulations in India, HSN codes are required on invoices for businesses with an annual turnover exceeding 1.5 crores.

To ensure compliance with GST regulations and streamline the billing process, it's essential to create a quotation for the client before creating a GST invoice.

This allows you to obtain approval from the client and create a proforma invoice, which can be used to accept advance payments and simplify the process of creating a GST-compliant invoice. With tools like Refrens' free quotation generator and proforma invoice generator, businesses can create accurate and professional invoices that meet all necessary GST requirements.

When it comes to creating a GST invoice, businesses have the flexibility to design their own invoice format. However, the government has mandated specific fields that must be included on every GST invoice. By following these guidelines, businesses can ensure compliance with GST regulations and avoid any potential errors or issues.

When it comes to creating a GST invoice, the first step is to start with a clear and informative header. Begin by including the title of the invoice as “GST invoice”.

While it's not mandatory, it's a good practice to follow as it helps to provide clarity to the recipient. Additionally, include the invoice number, date, and due date.

The due date can help automate reminders to clients and ensure timely payment. Don't forget to add a purchase order or quotation number if applicable. Finally, consider uploading your business logo to personalize your invoice.

Your supplier information is an essential component of your GST invoice. It should include your business name, address, and contact details, as well as your GST registered number. If you're issuing a GST invoice, having a GSTIN number is compulsory. When you add your GSTIN, your PAN number will automatically be fetched from the GSTIN and added to the bill.

When adding recipient information, be sure to include their name, address, and GST details. If the recipient isn't registered under GST, and the taxable amount is 50,000 or more, it's compulsory to include the name of the state and its code. Having these details saved will save you time and effort when creating future invoices.

If you're selling tangible goods, shipping details must be included. This includes the delivery address, state, challan number, transport, and date of delivery. However, if you're selling intangible goods or services, shipping details aren't required.

When describing goods or services, select the invoice currency from the dropdown box. Then, add a line, item, or service with a detailed description, quantity, rate, and amount. Customize and hide any columns of the lien item description as per the requirements of the GST invoice.

Adding GST is an important component of the invoice. Enable GST and add rates like 18%, 12%, or 5% and the HSN/SAC code. If you're using software like Refrens GST bill format, the taxable amount will be auto-calculated and divided equally as per the state selected in the address field.

Finally, it's compulsory to have the place of supply and country of supply when creating a GST invoice format.

The additional notes section is an excellent place to include anything else that doesn't fit into the mandatory fields. Consider uploading your signature image or signing by using your mouse to make your invoice look professional.

To personalize GST invoices effectively, utilizing a GST Bill Generator can be a game-changer. One of the key aspects of customization is incorporating your business's logo into the invoices, as it adds a professional touch. This small but impactful detail can contribute to creating a strong brand identity.

Moreover, customization goes beyond just adding a logo. With GST invoice templates, you have the flexibility to tailor the invoices according to your specific business needs. This includes adding extra fields and columns to accommodate unique requirements and provide a comprehensive overview of the transactions.

The beauty of customization lies in the ability to make the invoice reflect your brand's style. Whether you want to infuse a pop of color, include specific details, or follow a particular layout, there's a template available that can align with your preferences. By leveraging the customization options offered by a GST invoice generator, you can go beyond generic invoices and create a distinct, branded invoice that stands out professionally.

Refrens provides a variety of free invoice templates to cater to the diverse needs of different users. These templates cover a wide range of professionals, freelancers invoice templates, import-export traders invoice templates, GST-registered vendors, IT professionals invoice templates, consultants invoice templates, and more. Here's a brief overview of the types of invoice templates Refrens offers:

With Refrens, users can choose the template that best fits their invoicing needs, ensuring a professional and efficient invoicing process.

When supplying goods and creating a GST invoice using a free invoice maker, it is typically required to generate three copies of the invoice. These copies serve different purposes in the supply chain:

By creating and distributing these three copies, all parties involved in the supply chain have access to the necessary documentation, promoting transparency and ensuring compliance with GST regulations.

When supplying services and creating a GST invoice using a free invoice maker, two copies of the invoice are typically required. These copies serve different purposes in documenting the transaction:

Unlike the supply of goods, where a triplicate copy is also created for the transportation process, the supply of services involves only the creation of an original and a duplicate copy. These copies help ensure that both the service provider and the recipient have comprehensive records of the transaction.

Effortless Invoicing with GST Compliance

Refrens GST bill generator streamlines the entire invoicing process. Easily create, manage, and track invoices and bills while adhering to GST rules. Our platform ensures that your invoices are compliant with GST regulations, saving you time and effort in managing tax-related complexities.

Seamless Communication with Clients

In addition to its invoicing capabilities, Refrens also facilitates seamless communication with clients. The platform enables you to send invoices directly to clients through its mailing system. You can stay informed about the status of your invoices, knowing when they are delivered and opened by clients. If a client hasn't opened the email, the platform provides a "Send Reminder" feature to prompt them, ensuring timely attention to your invoices. This feature enhances communication efficiency and helps you maintain a smooth invoicing process with your clients.

Multiple Options for Sharing GST Invoices

Refrens offers a range of options for sharing your GST invoices, providing flexibility and convenience in your invoicing process:

Secure Online Payments for Faster Transactions

Refrens provides a secure and efficient solution for online payments, ensuring a faster and smoother transaction experience for both you and your clients. Here's how Refrens facilitates secure online payments through its platform:

Refrens provide simple, easy-to-understand, and fastest billing software for small businesses and freelancers. Refrens GST invoices are specially designed for Indian Markets. Our online bill generator does all the work for the business which includes creating and managing invoices, recurring invoices, collecting payments, and many more.

Just fill in the required information and create invoices within seconds. Make professional GST invoices with one click without prior knowledge of GST with an online GST invoice generator. Build your brand by adding a personal logo, digital signature, terms, and attachments like files, images, and many more. The simple-to-use interface helps you to manage all your invoices in one place without any cumbersome.

Not just GST invoices, Refrens online GST bill generator also supports more than 200+ countries and multiple currencies which includes the rarest of the rare. You can change the currency on the invoices with one click if your business has global clients. On Refrens, it is easy to create e-invoices under GST and generate your e-invoice IRN within seconds.

Receive online payments faster with Refrens GST bill generator. You can receive online payments through UPI, Net Banking, Debit/Credit cards, and many other ways. Currently, Refrens is one of the most trusted platforms in India to receive international payments. All the payouts are made within 2 transaction days.

Online bill generator gives options to Email the invoices to your client, Download them as PDFs, and print invoices. Not only this, but you can also share through WhatsApp and also by sharing the link(after copying the link).

The best part is Refrens GST Invoice Maker is FREE. No registration or signup fee. No Hidden Charges. No Conditions.

Refrens GST invoice generator provides various reports which ease the process of the invoicing cycle in many ways. As you create GST invoices or bills for the client, reports are created for you. You get different reports such as client reports, payment reports, TDS reports, and GST reports.

Not just reports, you can also manage all your clients under a client management system where you can add, edit and create invoices against each client individually. Alongside you can add those clients to the portfolio as well. Under the client report, you get all the invoices created against each client and also the average paying date of each one.

The payment report helps you to keep track of all the invoices paid by your clients. You can also track the payment mode and status of the invoice (approved, timeout, success). Refrens also provides a GSTR-1 report which is helpful for filing taxes. If you need any report that is not currently there, you can request us on chat support, we will get it included in our system.

There are many benefits of using a GST invoice maker. Some major ones are quoted below:

If you are specifically looking for a bill generator that helps you create invoices for reimbursement expenses you can check out our utility bill generator for free.