A Debt Dispute Letter is a written refusal to accept debt in response to a collector's notice. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. There's an official procedure to follow if you decide to enter a dispute with either a creditor or a debt collector, acting on behalf of a creditor. It is important to gather knowledgeable resources to know where you stand.

After receiving a debt collector's notice, you have 30 days to dispute a debt. Your written reply is the Letter of Debt Dispute. During this 30-day window, collectors will not be eligible to collect payments from you or take you to court.

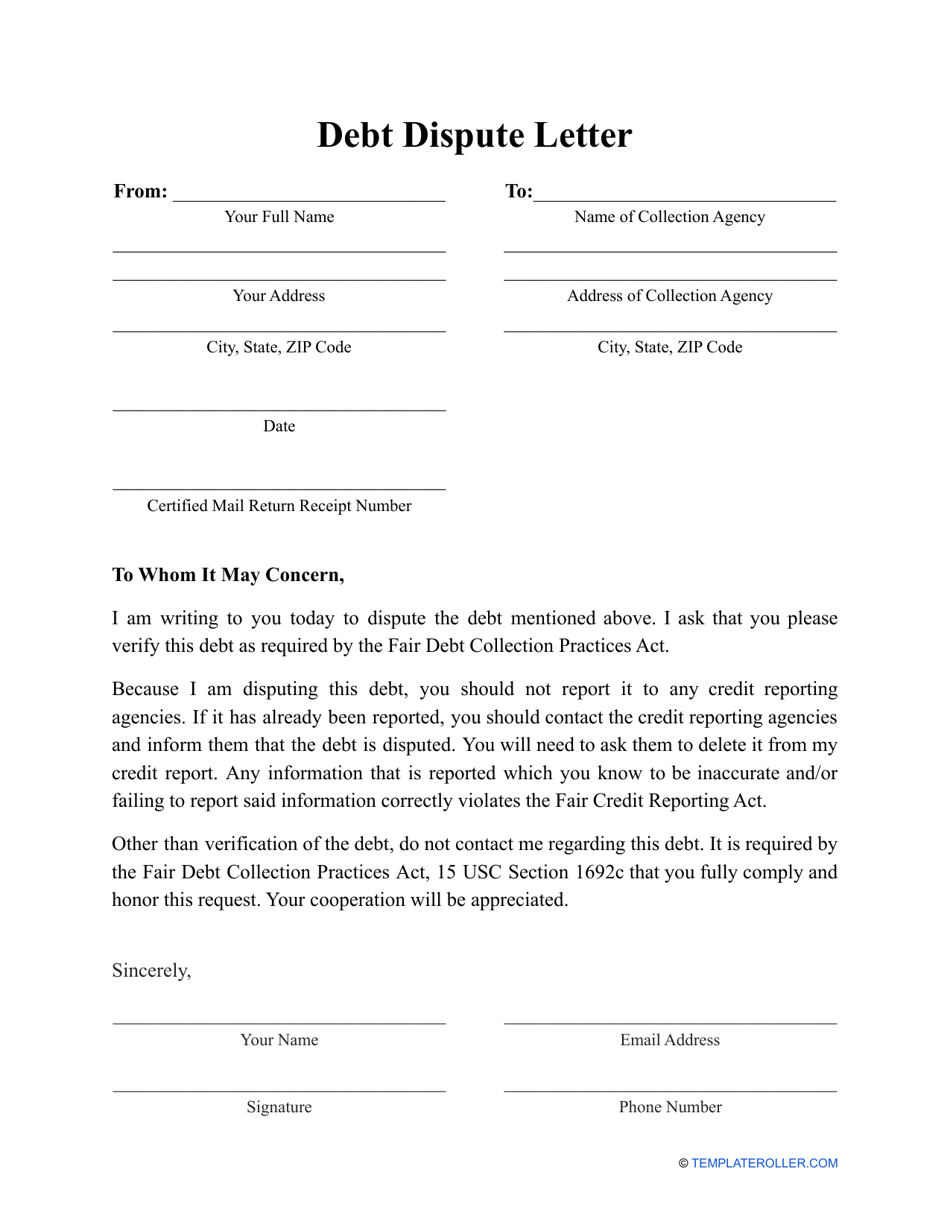

You can download a customizable and printable Debt Dispute Letter through the link below.

ADVERTISEMENTTo write a Debt Dispute Letter, you will need to follow the following steps:

Be very specific describing the reasons why you believe the debt is not yours, why the amount you are supposed to pay differs from the collector's records, or because of what else you think there was a mistake. While making the statements mentioned above, the Federal Trade Commission advises people to try to provide as little personal information as possible. Any personal information can be used against you if legal action will be taken in the future.

To conclude the letter sign and date it. Make sure to use certified mail to post your letter, with proof of a receipt. Keep a personal copy on file for future references if such a need occurs.

Not what you were looking for? Check out these related templates:

Debt Dispute Letter Template Debt Validation Letter Debt Validation Template Credit Bureau Credit Dispute Dispute Letter Template Debt Collector Debt Negotiation Debt Management Debt Settlement Debt Letter Template Credit Score Debt Repayment Credit Report Form Consumer Rights Debt Collection Welfare Benefits Letters Dispute Resolution Form

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.